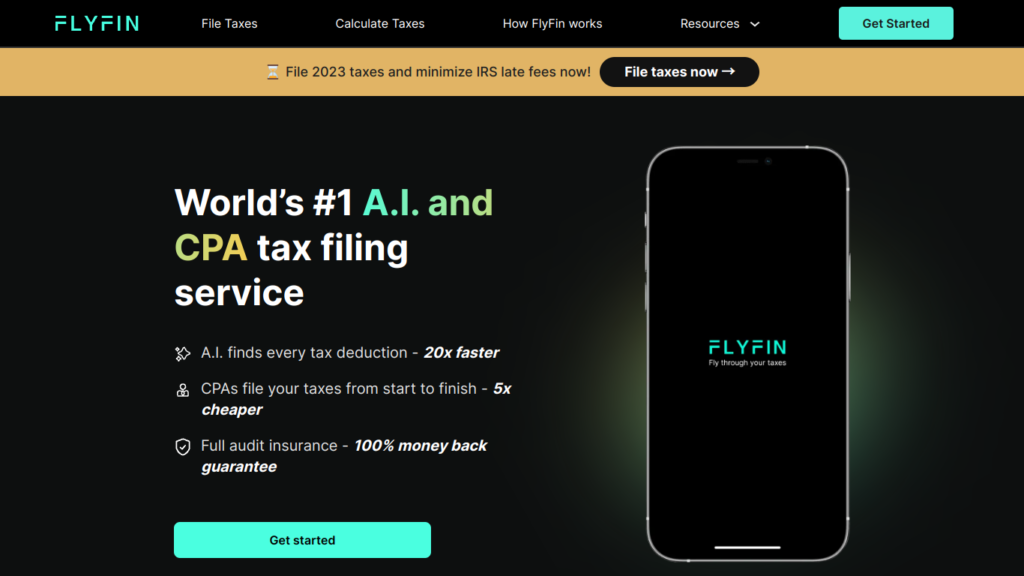

FlyFin is a leading tax service designed specifically for freelancers, self-employed individuals, business owners, and 1099 & W-2 workers. With FlyFin, filing taxes has never been easier or more efficient. The platform utilizes cutting-edge technology to streamline the tax filing process, saving you valuable time and ensuring accuracy.

One of the standout features of FlyFin is its ability to find every possible tax deduction, ensuring that you are maximizing your refund potential. By automating the process and eliminating 95% of the work typically associated with tax filing, FlyFin allows you to focus on your work while the platform takes care of the rest.

Additionally, FlyFin offers the expertise of a team of CPAs to handle your tax preparation from start to finish. This not only ensures that your taxes are filed accurately and in compliance with federal and state regulations, but also provides peace of mind knowing that your financial affairs are in capable hands.

With a user-friendly interface, detailed resources, and a range of plans to choose from, FlyFin makes tax filing accessible and stress-free. Whether you’re a seasoned freelancer or just starting out, FlyFin can help you save time, money, and hassle when it comes to managing your taxes.